There are generally four types of corporations that are commonly used for incorporation:

- C Corporation

- S Corporation

- Nonprofit Corporation

- Professional Corporation

To compare top-level attributes for each type of corporation and compare them to other business structures, please visit our Business Structures Chart.

Limited liability company (LLC)

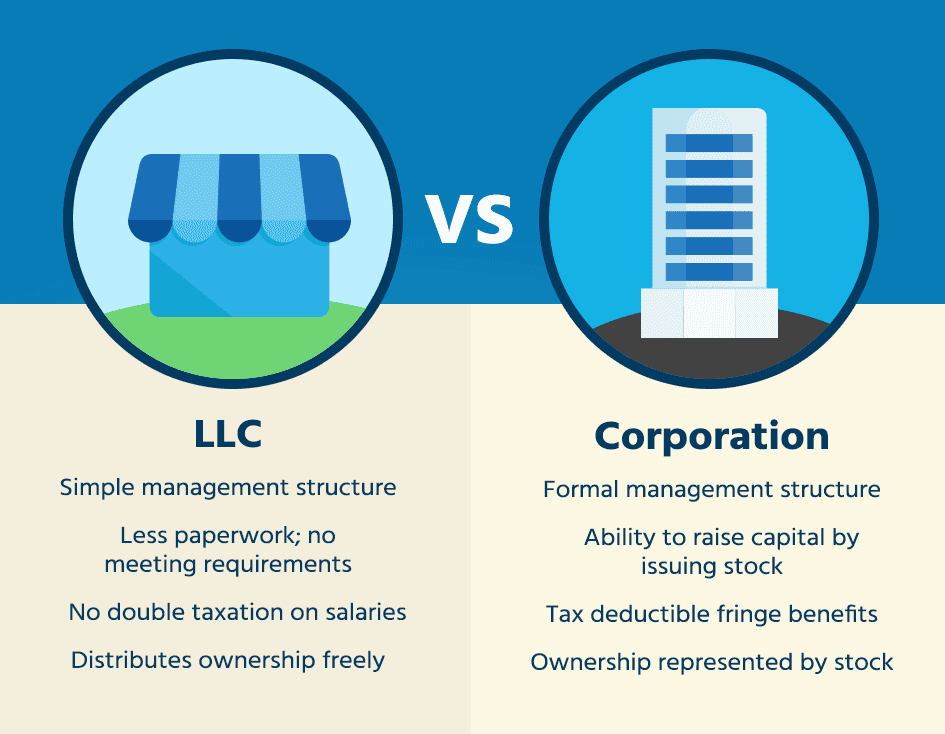

A limited liability company is a business entity that offers some separation of the people owning the business from the business itself. An LLC protects its owners (known as “members”) from being financially liable for most debts and damages and protects their personal assets in the event a business fails.

Forming an LLC requires that the business owner(s) file articles of incorporation. These articles outline the structure of the business. This is where LLCs rise above the other business entity types available to US small businesspeople—an LLC can opt for many different operating models: a 50/50 partnership, or even maintain a board of directors, like a C corporation.

The main advantage to forming and operating as an LLC lies in its simplicity. Income is taxed at the personal level one time, as opposed to at the corporate level, or both the corporate and personal levels (“double taxation”). LLCs can also choose what tax treatment works best for them—they can opt for pass-through taxation, like an S corp, or double taxation, like a C corp.

See our state specific guides for California LLC, Texas LLC and Florida LLC.

C Corporation

- A C Corporation is also known as a general for-profit corporation.

- The C Corporation is the most common form of corporate entity.

- The C Corporation is formed by filing an Articles of Incorporation with the state office.

- The C Corporation is owned by shareholders and there is no limit on the number of shareholders in a C Corporation.

- The shareholders elect a Board of Directors to create and direct the high-level policies of the business. This Board of Directors then appoints corporate officers who in turn manage the day-to-day operations of the business.

- Shareholders generally have limited liability, even if they are involved in the day-to-day management while wearing the hat of an employee or a corporate officer.

- The shares of a corporation are freely transferable unless limited by the agreement of the shareholders.

- The corporation exists indefinitely, unless and until it is dissolved.

- It is a separately taxable entity, meaning that it must file its own tax return and pay corporate taxes on its profits.

S Corporation

An S Corporation is formed in the same way that a C Corporation. However, the S Corporation is different from a C Corporation in two significant ways:

- The S Corporation makes an election to be taxed as a pass-through entity under subchapter S of the Internal Revenue Code. This means that an S Corporation is not taxed separately and apart from its owners and/or shareholders. Instead, corporate profits and losses are passed-through and reported on the personal income tax returns of the shareholders, much like a partnership.

- In contrast to a C Corporation, an S Corporation has limitations on ownership.

- In an S Corporation:

- There is a limit of up to 100 shareholders.

- Each shareholder must be an individual or a trust (not another corporation)

- Each individual shareholder must be a citizen of the United States or a “Resident Alien” which includes Permanent Residents (a person who has been issued a Green Card) and certain Aliens who pass the Substantial Presence Test. These residents (who pass the Substantial Presence Test) need not be permanent residents. They can be Visa holders (H1/L1) and still be considered Resident Alien per tax laws.

Nonprofit Corporation

For those groups that are formed for charitable, educational, religious, literary, or scientific purposes, and not for the purpose of generating profits for its shareholders, a special legal entity may be formed under Section 501(c)(3) of the Internal Revenue Code. A fully and properly qualified 501(c)3 Nonprofit Corporation has the following characteristics:

- The corporation is exempt from taxation.

- Tax-exempt corporations are prohibited from paying dividends.

- Upon dissolution, corporate assets must generally be distributed to another qualified nonprofit group.

- Significant filing requirements may exist at both the State and Federal level to establish and maintain tax-exempt status.

- A nonprofit corporation may be prohibited from engaging in certain activities, including participating in political campaigns and substantial engagement in lobbying activities.

Professional Corporation

- A Professional Corporation is used by businesses that provide a professional service. Examples include:

- Physicians or Doctors

- Attorneys or Law Firms

- Accounting Professionals or CPAs

- Architects

- And other licensed professionals

- Most states have special filing requirements when incorporating.

- A Professional Corporation can shield a professional service provider (doctors, attorneys, accountants, etc.) from liability for the operations of the business.

- The tax advantages for a Professional Corporation are the same as the advantages afforded to a C Corporation or S Corporation.

- Corporate filing requirements can vary and may be more or less expansive depending on your state.

- Laws governing professional services and corporations are often quite complex. We strongly urge you to consult with an attorney before making the decision to incorporate as a professional corporation.

State of incorporation

Small business owners in the US may incorporate their company in any of the 50 states. The state in which you incorporate your small business determines a variety of important factors, not just which laws your company is subject to. It will dictate how your business is taxed and even where you can sue or be sued.

Variables to consider when choosing where to incorporate your small business include:

- Geographical convenience. Is the state of incorporation easy to get to?

- Minimum owners. Certain states require a certain number of people to establish a business.

- Tax structure. How much does the state levy annually in corporate franchise tax? Will income your business earns elsewhere be subject to taxes in the state of incorporation?

- Records. Some states require that you keep records within state lines.

- Banking. Some states require that a corporate bank account exist, and oftentimes within the boundaries of the state of incorporation.

Special requirements for special fields

Certain fields requiring special certification or licenses—such as medical or legal practice—are limited in terms of what types of business entity practitioners can elect to form. Depending on the state of incorporation, groups of such professionals may have to come together in the form of a professional corporation or professional services corporation.

Professional services corporations allow licensed professionals to benefit from the liability protections embedded in traditional corporate structures, excluding malpractice claims against licensed practitioners themselves. Professional services corporations are taxed like C corps. They are subject to corporate tax, as well as tax on shareholder distributions.

In some states, such as California or Virginia, professionals may organize into LLPs or LLCs. The main difference between an LLP/LLC model and a professional services corporation is that the latter must pay income taxes on the corporation itself, like a C corp, whereas with LLPs and LLCs, members pay personal income taxes on income received.

Occupations covered by these state mandates may include:

- Lawyers (lawyers are barred from forming LLCs in some states)

- Accountants

- Health care professionals

- Engineers and architects