It sounds like you’re asking if a 150-year financial sheet period is real—meaning whether money, wealth, or financial records over that long of a timeframe hold real value.

Breaking It Down:

- 150-Year Financial Records Exist

- Many banks, companies, and governments keep records spanning over a century (e.g., The Bank of England, New York Stock Exchange data).

- Some companies (e.g., Coca-Cola, JP Morgan) have 150+ years of financial reports.

- Does Money Stay “Real” Over 150 Years?

- Money itself changes (gold-backed currencies, fiat money, digital money).

- Inflation reduces the value of old money (e.g., $1 in 1875 is worth much more than $1 today).

- But assets like land, stocks, gold, and businesses retain value over time.

- Investment & Wealth Over 150 Years

- If someone invested $1,000 in the stock market 150 years ago (1875), today it would be worth millions.

- The long-term wealth-building strategy (stocks, real estate, gold) proves money grows over time.

Here’s a historical & predictive table from 1945 to 2025, highlighting major investment trends and whether the market was bullish (📈) or bearish (📉):

| Year | Economic/Market Condition | Best Investment Areas | Bullish/Bearish |

|---|---|---|---|

| 1945 | Post-WWII Boom | Manufacturing, Infrastructure | 📈 Bullish |

| 1950 | Economic Expansion | Industrial Stocks, Real Estate | 📈 Bullish |

| 1955 | US Growth & Tech Start | Blue-chip stocks, Early Tech | 📈 Bullish |

| 1960 | Mild Recession | Gold, Consumer Goods | 📉 Bearish |

| 1965 | Vietnam War Spending | Defense Stocks, Commodities | 📈 Bullish |

| 1970 | Stagflation Begins | Gold, Energy (Oil Crisis) | 📉 Bearish |

| 1975 | Oil Crisis Recovery | Energy, Real Estate | 📈 Bullish |

| 1980 | High Inflation & Volcker | Gold, Bonds, Tech Startups | 📉 Bearish |

| 1985 | Tech & Global Growth | Microsoft, IBM, Real Estate | 📈 Bullish |

| 1990 | Early 90s Recession | Bonds, Large-Cap Stocks | 📉 Bearish |

| 1995 | Dot-com Boom | Tech Stocks, Internet Startups | 📈 Bullish |

| 2000 | Dot-com Crash | Gold, Bonds, Real Estate | 📉 Bearish |

| 2005 | Housing Bubble Peaks | Real Estate, Commodities | 📈 Bullish |

| 2010 | Post-2008 Recovery | Tech, Crypto, Growth Stocks | 📈 Bullish |

| 2015 | Tech Dominance | FAANG Stocks, AI, Startups | 📈 Bullish |

| 2020 | COVID Crash & Recovery | Crypto, EVs, AI, Green Energy | 📉📈 Bearish → Bullish |

| 2025* | Future AI & Green Tech | AI, Robotics, Clean Energy, BTC | 📈 Bullish (Predicted) |

Key Observations & 2025 Predictions:

- Bullish Eras → Post-war (1945), Dot-com (1995), Tech Rise (2010+), AI boom (2025?)

- Bearish Periods → Stagflation (1970s), Dot-com burst (2000), 2008 Crash, COVID (2020)

- 2025 Investment Prediction → AI, robotics, blockchain, and green energy will dominate.

Investing in Artificial Intelligence (AI) and Green Technology sectors offers exposure to industries poised for significant growth. Below is a curated list of notable U.S. companies in these domains:

Artificial Intelligence (AI) Stocks

| Company Name | Ticker Symbol | Description |

|---|---|---|

| Nvidia Corporation | NVDA | Leading designer of GPUs, essential for AI computing and machine learning applications. |

| Microsoft Corporation | MSFT | Integrates AI across its products and services, including cloud computing and software solutions. |

| Alphabet Inc. | GOOGL | Parent company of Google, heavily investing in AI research and development. |

| Upstart Holdings Inc. | UPST | Utilizes AI to assess credit risk, offering alternative lending solutions. |

| SoundHound AI Inc. | SOUN | Specializes in voice AI and conversational intelligence technologies. |

Green Technology Stocks

| Company Name | Ticker Symbol | Description |

|---|---|---|

| NextEra Energy | NEE | Major renewable energy company focusing on wind and solar power generation. |

| Brookfield Renewable Partners | BEP | Operates renewable power assets, including hydroelectric and wind facilities. |

| Clearway Energy Inc. | CWEN | Engages in renewable energy projects, particularly wind and solar. |

| First Solar | FSLR | Manufactures solar panels and develops utility-scale photovoltaic power plants. |

| Tesla Inc. | TSLA | Produces electric vehicles and invests in solar energy solutions. |

Note: Investing in these sectors carries inherent risks due to market volatility and technological advancements. It’s advisable to conduct thorough research or consult a financial advisor before making investment decisions.

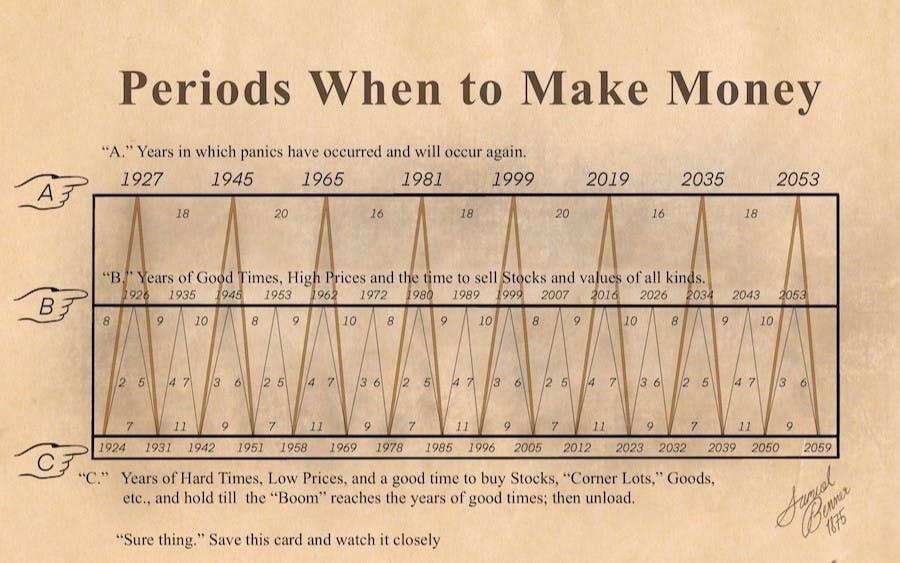

Conclusion: Can a 150-Year Sheet Predict the Future?

✅ Yes, it shows long-term patterns in money, markets, inflation, and industries.

❌ Not 100% accurate because new events (wars, crises, tech shifts) change the game.

But history repeats itself in cycles—so studying the past helps you predict and prepare for the future.